Cyclescheme Certificates

Cyclescheme cycle to work certificates can be redeemed with Tredz through our online checkout for quick and easy ordering, so you get your new bike, kit and accessories even faster. Riding to work is a great way to get fitter and help the environment. WE are happy to help you achieve your goals with your new Cyclescheme bike.

How does Cyclescheme work?

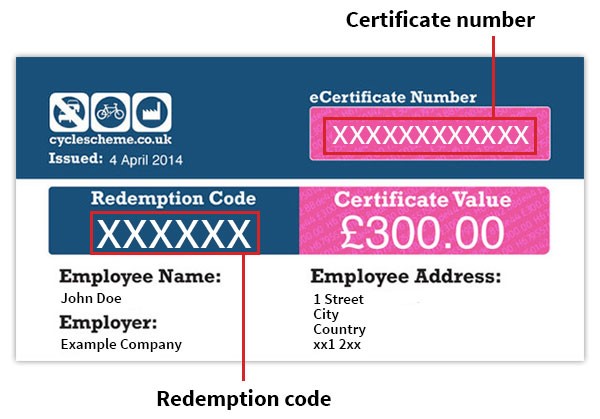

- Have your certificate to hand which contains your certificate number and redemption code.

- Add the eligible items to your basket that you wish to purchase through the scheme.

- In your basket, enter your certificate number and click apply. You will see the value of your certificate removed from your order total.

- Continue through the checkout process as normal, choosing a delivery address that suits you.

- At the last stage of the checkout, simply enter your redemption code to fulfil your Cyclescheme payment.

- Complete your purchase and we will arrange delivery.

Frequently asked questions

Before you order

Any bike that you can use for commuting is eligible to buy through Cycle to Work. You can choose a lightweight road bike, sporty hybrid, rugged mountain bike, compact folding bike or even an ebike. Kid’s bikes are not eligible.

You can also use your voucher to get any safety equipment you need for commuting. This might include:

- Helmets

- Bells

- Lights

- Luggage

- Locks

- Child safety seats

- Pumps and repair kits

- Reflective clothing

We will reserve your bike as soon as we receive your certificate. Alternatively, you can contact us through Live Chat and we will reserve your bike for you before we receive your certificate.

While you order

With Cyclescheme the amount you spend is up to your employer. Cyclescheme don’t impose a limit themselves but your employer might set their own limit. This might be £1,000 or a higher figure. Contact your HR department to find out how much you can spend.

Cyclescheme no longer accept tops ups, so you can’t add your own personal funds to buy a more expensive bike than your employer allows.

Yes, you can use your Cyclescheme voucher on any discounted or clearance bikes and eligible accessories.

Yes, price match is available Cycle to Work orders with Cyclescheme.

Terms and conditions apply. See our Price Match Policy for more details (Link in Footer).

You can buy multiple bikes as long as they are the same size and the total basket does not exceed the value of your voucher.

Your certificate number and redemption code can be found on your Cyclescheme certificate, which will be given to you by your HR department.

After you order

Everybody who earns their salary via PAYE (Pay As You Earn) can participate in the Cycle to Work scheme.

Please note: You will not be eligible to use the scheme if your salary sacrifice drops your gross pay below that of minimum wage.

You can sign yourself up to a Cycle to Work scheme as long as you pay your tax through PAYE.

Any bike that you can use for commuting is eligible to buy through Cycle to Work. You can choose a lightweight road bike, sporty hybrid, rugged mountain bike, compact folding bike or even an ebike. Kid’s bikes are not eligible.

You can also use your voucher to get any safety equipment you need for commuting. This might include:

- Helmets

- Bells

- Lights

- Luggage

- Locks

- Child safety seats

- Pumps and repair kits

- Reflective clothing

We accept Cycle to Work vouchers from most national schemes like Cyclescheme and Cycleplus.

We also accept vouchers from in-house schemes run by independent companies, as well as Halfords Cycle2Work vouchers. If your voucher is from any other scheme, please get in touch at info@tredz.co.uk to check if we can accept it.

Usually your first payment will be taken from the next salary period after you signed your hire agreement.

For the duration of your hire period it is your employer that owns your bike and equipment. Your employer buys your bike and equipment and the leases it to you through an interest-free salary sacrifice scheme. The cost of your items is deducted from your salary as a non-cash benefit, so you can get savings on tax and national insurance.

It is your responsibility to insure your bike. If your bike is stolen or damaged beyond repair, you’ll continue to make your monthly payments until it has been paid for. We highly recommend you insure your bike.

To keep the Cycle to Work scheme tax free, there is no guarantee your employer will transfer ownership to you at the end of the hire period. This is usually what happens, but just make sure you check with your scheme provider first.

You have 3 options on how to end your hire agreement.

1. You can choose to return your bike to your Cycle to Work provider

2. You immediately take ownership of your bike and pay up to 25% of the ‘fair market value’

HMRC has set fair market values that employers must pay to keep the bike. So, you may be asked to pay up to 25% of the value of a bike costing more than £500 after 12 months.

Fair Market Value

| Age of bike | Less than £500 | More than £500 |

|---|---|---|

| 1 year | 18% | 25% |

| 18 months | 16% | 21% |

| 2 years | 13% | 17% |

| 3 years | 8% | 12% |

| 4 years | 3% | 7% |

3. Extend your hire agreement to 36 months for a single small refundable deposit (3% or 7%).

During your extended hire agreement, you will make no further monthly payments. At the end of the 36 months you can either choose to send your bike back to your Cycle to Work provider (and your deposit will be refunded) or you take ownership of the bike. No further payments are needed.

If you leave employment during your hire agreement any balance remaining will be repaid from your final net salary. Unfortunately, you will not benefit from tax and National Insurance savings.